For example, if you simply want to get a better handle on excess personal spending, choose a personal finance software platform that focuses on personal habit tracking and budgeting. Personal finance software is helpful for a variety of purposes, but it’s important to know what your true goals are before you make the switch.

Your finance team can catch mistakes before they lead to major consequences.You can keep tabs on expense management, savings goals, and investment accounts.Automated software makes processes like payroll incredibly easy.Financial services let you track financial habits more accurately by connecting to your bank account.The constantly moving pieces are difficult to maintain without some level of automation. Many of us require a helping hand with our personal finances.

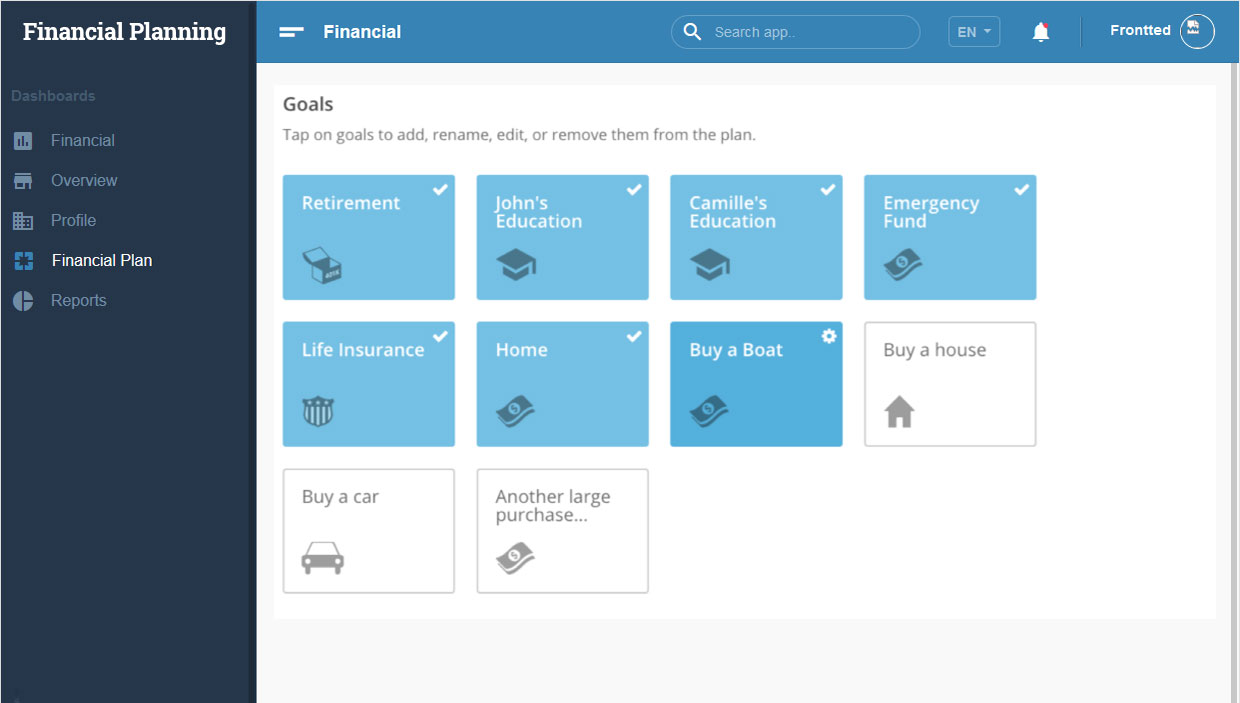

Key Takeaways Advantages of Using Personal Finance Software How Can Software Transform Your Finances? In this post, discover 10 tools that help with expense tracking, budgeting, cash flow, and more.Īdvantages of Using Personal Finance Software Since the choices can be overwhelming, we’ve narrowed down the best financial data software options for you. Instead, desktop software and cloud-based tools are the keys to financial success. When it comes to managing business accounting, manual processes are no longer the industry standard.

0 kommentar(er)

0 kommentar(er)